Funding Options for Real Estate Developers

Acquiring land is the first step in any real estate development journey, and it often requires significant financial planning and expertise. We assist developers in securing funding for land acquisition. Our solutions are tailored to meet the unique requirements of each project, ensuring compliance with local regulations and maximizing investment potential. Whether you’re looking to acquire land in the top metros, state capitals, or emerging cities across India, our financing options cover diverse geographies and project types. We understand the time-sensitive funding needs and our funding solutions empower developers to focus on their vision while ensuring a smooth and efficient process and expert guidance in negotiating favorable terms.

Stalled real estate projects pose challenges not only to developers but also to investors and buyers. Our expertise lies in providing funding solutions that help restart stalled projects and bring them to completion. We arrange financing through AIFs, Foreign Funds, NBFCs, and Banks, offering customized options to address specific project hurdles, whether financial, legal, or operational. We focus on revitalizing projects in India’s top metros, state capitals, and other key markets, ensuring timely execution and delivery. Our solutions include refinancing, additional finance to overcome obstacles and get the project back on track. With our support, developers can rebuild trust with stakeholders and create value from stalled assets.

Project buyouts provide opportunities to acquire partially completed or distressed projects and realize their full potential. We arrange funding for developers and investors looking to take over such projects, ensuring a seamless transition and continuity. Our strong relationships with lenders and investors enable us to structure innovative financing solutions for buyouts. We understand the project’s current status, risks, and secure the necessary funds to complete the development. Whether in top metros or other locations, we ensure that project buyouts are strategically executed to maximize returns and minimize disruptions.

Stalled projects often face compounded challenges when linked to developers with low credit scores or classified as NPAs (Non-Performing Assets). We specialize in arranging funding for such situations through AIFs, Foreign Funds, NBFCs, and HNIs that understand the complexities of distressed assets. Our customized financing solutions help developers navigate these challenges by restructuring existing loans, securing fresh capital, and addressing compliance requirements. By leveraging our expertise, developers can mitigate risks and restore stalled projects, turning liabilities into opportunities. Our PAN India coverage ensures that no matter where the project is located, we have the resources to assist.

Lease Rental Discounting (LRD) is a powerful tool for developers to unlock the value of leased assets. We arrange LRD funding through AIFs, NBFCs, and Banks, enabling developers to generate liquidity while retaining ownership of their assets. For those seeking additional funding, we provide LRD with top-up facilities to address incremental financial needs. Our solutions cater to developers across India, from top metros to tier-II cities, ensuring that leased properties become a reliable source of capital. We assist in evaluating lease agreements, structuring the financing, and securing competitive terms to optimize cash flow and project execution.

The sale of leased properties is a strategic move for developers seeking to unlock capital tied up in assets. We arrange funding for buyers interested in acquiring such properties, ensuring a smooth transaction process. Our partnerships with various Indian and overseas investors enable us to facilitate competitive financing options for developers and investors alike. Whether the leased properties are located in top metros or emerging markets across India, we prioritize building lasting relationships by supporting seamless ownership transitions and delivering value for developers and investors alike.

Premium funding is essential for developers looking to cover project-specific costs such as approvals, premiums, and other statutory requirements. We arrange customized financing solutions through AIFs, NBFCs, and Banks to address these needs. Our funding options are designed to ensure timely project execution without straining cash flows. With our PAN India reach, we cater to developers in the top metros, state capitals, and beyond. Our expertise in structuring premium funding solutions helps developers maintain momentum in their projects, ensuring compliance and efficiency.

Construction finance is the backbone of real estate development, and we specialize in arranging funding tailored to various project needs. Through AIFs, Foreign Funds, NBFCs, and Banks, we provide solutions for a variety of project types:

- Without Additional Collateral: Access funding without the need to pledge additional assets, ensuring flexibility and speed.

- Own Land Projects: Leverage your land ownership to secure construction finance on favorable terms.

- Joint Development Projects: Collaborate with partners seamlessly with our structured funding for joint development projects.

- Redevelopment of Existing Societies: Transform existing properties with specialized financing for redevelopment projects.

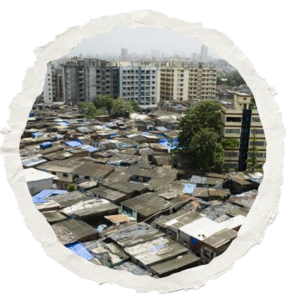

- SRA (Slum Rehabilitation Authority) Projects: Support SRA projects with funding tailored to their unique challenges and opportunities.

Our construction finance solutions are available across India’s top metros, state capitals, and beyond, ensuring that developers can execute projects efficiently and effectively.

Land plotting projects represent a significant opportunity for developers to transform raw land into profitable, planned ventures. We specialize in arranging funding through Specialized Funds, NBFCs, and Banks to support these initiatives. Our financial solutions are designed to address the unique challenges of land plotting, providing developers with the capital required for essential infrastructure development and execution.

While we focus exclusively on funding, our expertise ensures that developers can access timely and competitive financing to drive their projects forward. Whether the projects are located in India’s top metros, state capitals, or emerging markets, our network of financial partners enables us to deliver customized funding options tailored to the specific needs of land plotting initiatives. By alleviating financial constraints, we empower developers to seize market opportunities, enhance property value, and deliver planned plots that meet market demand.

Project takeovers at lower costs present lucrative opportunities for developers and investors alike. Often, developers begin projects with high-cost loans due to higher risk factors or the inclusion of expenses like land purchase, approval costs, and premium payments. As the project progresses and risks reduce, we specialize in arranging funding to refinance these loans at more competitive rates.

Our refinancing solutions are facilitated through Banks and NBFCs, ensuring that developers can optimize their financial structures without disrupting existing relationships with initial lenders. By securing lower-cost funding, developers can improve project viability and profitability while aligning with their long-term strategic goals. Whether the projects are located in India’s top metros or other key locations, our expertise ensures a seamless and cost-effective transition to better financial terms, benefitting all stakeholders involved.

Project takeovers at lower costs present lucrative opportunities for developers and investors alike. Often, developers begin projects with high-cost loans due to higher risk factors or the inclusion of expenses like land purchase, approval costs, and premium payments. As the project progresses and risks reduce, we specialize in arranging funding to refinance these loans at more competitive rates.

Our refinancing solutions are facilitated through Banks and NBFCs, ensuring that developers can optimize their financial structures without disrupting existing relationships with initial lenders. By securing lower-cost funding, developers can improve project viability and profitability while aligning with their long-term strategic goals. Whether the projects are located in India’s top metros or other key locations, our expertise ensures a seamless and cost-effective transition to better financial terms, benefitting all stakeholders involved.